Businessweek’s economist, Mike Mandel, recently gave a presentation in which he put forth the contrary proposition that over the last decade the U.S. has failed at innovation. You can read the short version here at Phil Nussmaum’s OnDesign Businessweek Blog. The nut of Mandel’s argument is that by the economic measures of stock prices and wages, the last ten years have either been flat or even declining despite all the internet and biotech activity. The only business that really seemed to flourish was finance and we all know where that ended up. Mandel remains cautiously optimistic that we will return to prosperity in the medium term but as they say, “Past performance is no guarantee of future returns”.

I think we all sense that we are living through a time that in which we are undergoing a fundamental shift that is probably even greater than that which took place in the Industrial Revolution. Revolutions are unpredictable beasts that tend to get out of hand. The impact of a revolution is rarely foreseeable from within it. But a new culture will emerge out of this one as surely as the rise of the corporation and mass production rose from the last one. Utopian visions have always been a part of fundamental technology shifts. And they have almost always been wrong. The new culture brings not only progress but a new set of problems.

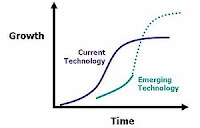

Mandel is pinning his hopes for recovery on the Usual Suspects of biotech, green energy, and the web. That may prove to be right because changes don’t simply come out of thin air. They have long incubation periods in which the emerging future looks like an adolescent that is noisy and best ignored. But one thing is clear, whatever happens it will come about because it provides a more economical way to meet people’s needs.

I have been reading an interesting book by Nicholas Carr entitled The Big Switch. Carr writes about the parallels between the impact of electric utilities of the 20th century and the emergence of “computing utilities” in the 21st century. Both dramatically reduce the cost and improve the reliability of a basic technology. The economies of scale that come with centralizing the technology in a utility make a whole new way of living possible. And those same economies make the emergence of the new technology inevitable.

So Carr would agree with Mandel that betting on the internet, or more precisely, computing as a utility is one way in which we will see innovation in the future. Green energy, even though it may be the way out of climate change, has to find a way in which it is the most cost effective solution. Maybe that happens through tax policy but if it is not the lowest cost provider, the market will choose a cheaper path. It always does.

The same might be true for pharmaceuticals and biotechs. The cost of discovering and producing a new drug is just too high. The problem that Big Pharma faces (and what is driving the mega mergers of the last decade) is a diminishing pipeline of good candidate drugs. When the costs for discovery and development are approaching a billion dollars, it is just too expensive to be sustainable. So what is needed here is a way to reduce those costs. Some think that the increasingly sophisticated use of mathematical models of biological processes, the so-called “in silico” biology will be the answer. Tests can be done in a computer much cheaper than they can be performed on a bench or at the bedside. But their relevance is only as good as the model itself.

We need much more innovation to break free of this recession. And the innovation needs to give us real results, not just the financial illusion of innovation. We are all depending on it.

No comments:

Post a Comment